Geek Articles

Feeling Insured: Understanding the Differences in Production and Equipment Insurance

“Jaws” writer Carl Gottlieb had a group of us enraptured on a set in New Mexico, talking about his location visit to the classic Robert Altman film, “MASH,” when two stuntmen acting perhaps ironically as dead bodies nearly went down with a helicopter just after it had taken off for a shot. They had requested specifically not to be tied down to the helicopter runners, ultimately saving their lives, as they were able to jump at the last moment from the medevac stretchers on the runners of the helicopter via palm tree fronds to safety.

The pilot was badly injured but not killed, while the helicopter itself, an important and expensive prop for the film, was destroyed. I was shocked, turning to the set’s veteran medic, asking dubiously, “do accidents like that happen a lot?”

“Oh yes!” she nodded emphatically, “all the time!” In less than an hour, she had to rush out to an actor that had fainted unexplained as he was delivering his lines. After the ambulance showed, the actor was taken to a hospital, while the shoot, with very sudden rewrites, had to go on, as another film project was scheduled to start at the very same location in only a few hours.

Thankfully, new technology like drones is starting to mitigate set hazards like helicopters – historically a number-one killer on motion pictures – but accidents continue to happen, even when long-established safety protocols are being observed. Releases as recent as “Deadpool 2”, “The Walking Dead,” and “Blade Runner: 2049” have all been subject to deaths during production.

Given the nature of filmmaking and proliferation of possible pitfalls during a shoot, the insurance needs, which vary not only by project but by state, can be extensive as well as confusing, to say the least. Social media services and the arrival of live video sites like YouTube, Instagram, and TikTok have greyed this area considerably.

Insurance is hardly exciting, and still photographers and vloggers, often a lot more nimble than a movie production, tend to play fast-and-loose when it comes to uninsured location work. However, there can still be accidents that can easily bankrupt a business and its owners.

At the very least, a production or a shoot can be shut down for the day, an expensive delay in the world of production that adds extra cost to already bloated budgets and tight scheduling. Worst-case scenarios? Destruction of highly expensive equipment, which must then be compensated for out-of-pocket, or worst-of-the-worst, permanent injuries or deaths, which can bankrupt a project as well as anyone held financially liable.

Also, if you’re a photographer or burgeoning filmmaker looking at making a profit on a motion project, you cannot ignore insurance. I mean that literally. No matter how good your project is, the sale of a project for streaming or theatrical distribution must include proof of insurance as well as E&O certification, Errors & Omissions, that most often must have been met during the production.

The national and worldwide distribution of motion pictures opens creators and distributors to several areas of litigation that are often unanticipated, everything from trademark infringement to defamation. James Cameron and the producers of Avatar were sued by a writer over E&O in 2011, for example, claiming that Cameron had been pitched the idea nearly twelve years earlier.

E&O is only available through said specialized entertainment insurance brokers, who perform functions a lot more akin to a lawyer than the more common insurance agents you’ll find at companies like Geico or State Farm. E&O is expensive, and it’s also only the start when it comes to motion picture production needs for insurance.

Do you want to know what it takes to insure a photography or a production company, soup-to-nuts? Most importantly, if creating a video project for profitable distribution, would you like a theatrical or streaming release? Looking simply to cover the usage of your own equipment in addition to the gear that you have rented? Do you want to ensure comprehensive coverage to address any number of production challenges, like injuries, accidents, shipping delays to shipping, or malfunctioning equipment?

How LensCap Works

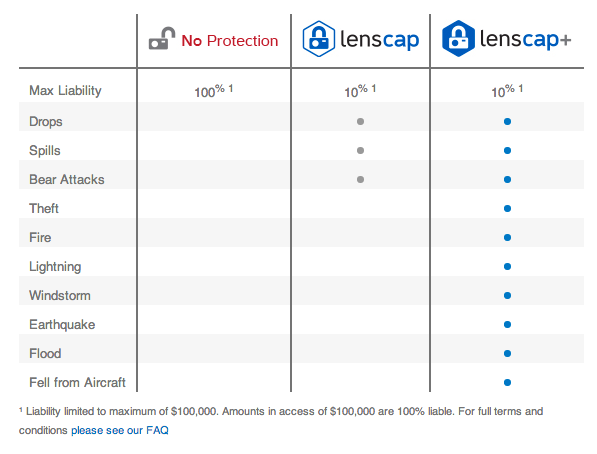

Many rental houses require rental insurance, but Lensrentals does not unless leasing above a certain gear threshold. They provide two versions of rental insurance for their customers, both available as a simple add-on during checkout.

Their in-house LensCap service comes in two flavors. As long as the equipment can be returned, the standard LensCap plan will cover any dropped gear, spills (but not submersions or major water damage), and, amusingly, bear attacks.

The more advanced LensCap+, as in “plus,” builds on these protections by adding worldwide coverage for theft, fire, lightning, windstorms, earthquakes, and even a drop from an aircraft.

If electing to skip coverage, any gear that has been rented Lensrentals and has been damaged will then be on you. You must either replace the gear or pay for it to be fixed. If you can’t send it back, you’ll have to replace it or pay the full estimated cost of the gear.

Neither plan covers transit losses, water or sand damage (i.e., shooting at the beach or any other harsh conditions), TSA confiscations, negligence, purposeful destruction, abusive usage, smoke damage, or sensor damage from direct exposure to the sun or laser lighting.

Easy! Well, easier than the rest. Most standard insurance companies like those with which you will have a car insurance policy can provide equipment and rental insurance. Still, in photography and videography, it is found under the more standard nomenclature of Inland Marine insurance. Funnily enough, “rental insurance” will not cover commercial equipment or gear, as this policy is designed only to cover personal possessions in a residence.

While an insurance agent often works for the insurance company in abiding by company standards, entertainment brokers have to be specially licensed. They do not sell more typical forms of insurance, either. (Conversely to inland coverage, Ocean Marine insurance covers anything that is being transported over water and overseas.)

Commercial or fleet automobile needs? Aerial or watercraft? Motorcycles on the set? ATVs? RVs? Honeywagons? Cranes or rigging? Diving? Animals? Pyrotechnics? Weapons? Stunts? Children? Children doing stunts (not gonna happen!)? Cyber risks to your project? Studio or sound stage protections? —These all require specific policies that can only be put together by specialized entertainment insurance brokers or their respective companies. (Some coverages are available piecemeal, however.)

Errors & Omissions for Photography and Production

In other areas of business, Errors & Omissions insurance, or Professional Liability, is designed to safeguard from claims that your business has not provided the appropriate service as advertised. It compensates for any lawsuits that may arise from claims of negligence. It pays for legal defense fees and helps compensate for court costs, attorney fees, and settlements.

For filmmaking, Errors & Omissions is there to cover lawsuits over things like copyright infringement, fair usage, invasion of privacy, missed deadlines, or improper formatting of video files. It also addresses conflicts as benign as plagiarism, name usage, mistaken credits, unprofessional behavior, “unfair competition,” or even claims that have no merit whatsoever. This latter case happens so often it is referred to on its own as False or Frivolous damage claims.

Director of Photography Steven Holleran on location while shooting for the Netflix series “Fire Chasers,” directed by Julian T. Pinder and produced by Leonardo DiCaprio. Though strictly following the orders of Cal Fire, with whom they were embedded, the historic and unprecedented spread of the Blue Cut fire immolated their production vehicle at what had been presumed to be a safe location.

With worldwide distribution, Errors & Omissions in motion pictures are an absolute necessity if you want to distribute your project for profit. No theatrical or streaming service will want to be culpable for the mistakes of the creators, and an E&O lawyer reviews projects case-by-case for title and subject clearance in advance of sales.

Even a website can be sued over E&O. Any LLC must include E&O coverage for federal income tax requirements by law, for instance. (On the other hand, doing business as LLC removes many of these listed financial obligations from the business owners.)

Entertainment insurance brokers require a good relationship with practically immediate accessibility to your agent. They can keep on their toes to match production’s needs while immediately addressing any insurance needs or dilemmas that can happen on a shoot.

Dice Insurance Policies VS. Annual or short Term Production Insurance

At a bare minimum of several thousand in upfront costs, an annual production insurance policy, also known as a DICE policy, an anagram for documentaries, industrial, corporate, and educational, will cover up to a couple-hundred-thousand dollars worth of total project budgets during a year.

A Panavision Primo SL14.5 full-frame lens was also destroyed during the Blue Cut fire. “That lens was actually a large-format Primo 70 Series 14mm, right when Panavision started making them,” laments Holleran. “Apparently, there were only a few in the world when we melted that one down to its screws!”

Short-term coverage for budgets of less than $1,000,000 are sometimes more cost-effective. Still, insurance policies for episodics or feature, full-length narratives will be most suited to an annual policy. Sometimes there is a mix of both, another important reason to develop a good relationship with an entertainment broker, as insurance costs will need to be accommodated to the needs of not only the principal shooting days but also to any peripheral workers employed during the course of the production, both on and off set.

DICE and more advanced policies will cover several considerations specific to production, like wardrobe, props, theft or loss, or both. They can be built to cover the property coverage needs of sets, sound stages, studios, offices, and even more unique situations such as broken vendor agreements, third-party automobiles, damage or loss to film stock or digital video files, and unfulfilled filming permits.

With a few exceptions, drone usage still needs an entertainment broker, and not all of them can handle this relatively new category. The FAA wants to make sure that no one is dropping small helicopters on the general populace from the sky.

General Liability VS. Workers’ Compensation for Video and Photography

While rental and equipment insurance are both available without general liability, a business will often need general liability in addition to these offerings, though not all states require it. Whether stills or motion, general liability covers for accidents on the set and damage to a location.

If talent or crew trips over a cord or a tripod, or have a piece of equipment fall on them, or if a piece of equipment falls on a floor or dents a wall, then general liability covers medical and repair costs sans deductibles. Lensrentals and their LensCap rental insurance services do not cover shipping losses, for example. Still, shipping companies have general liability to cover any damages or loss to equipment or packages while in transit. (Important hat tip: track equipment and be sure to document its condition when you receive or return said items.)

An artist that I know, horror-of-horrors, boxed and shipped a large, life-sized painting from Los Angeles to a New York gallery, only to have a forklift prong penetrate the box and canvas during the unloading. Since neither the gallery nor the painter was responsible for the damage, the shipping company had to compensate for the full value of the artwork, estimated at more than $10,000.

“What no one foresaw with the Blue Cut fire was the speed at which it moved, nor the multi-pronged way it encircled the canyon we were in,” says Holleran. “We watched 100ft flames moving at 50-60mph tear through the ravine where we were shooting, trapping us in a pig corral. In less than five minutes, our vehicle melted to the ground along with a substantial amount of gear.”

This was done through the shipping company’s general liability insurance, but the gallery’s insurance company negotiated on their behalf since they also had liability insurance. If it was just the artist, sans insurance, against the shipping company, it’s dubious that the settlement would have been satisfactory.

For productions, whether motion or stills, a COI, “Certificate of Insurance,” for general liability will be necessary for booking any number of situations. This includes but is not limited to the crew, talent, makeup, costuming, security, locations, medic services, and even catering or vendors if shooting live events.

Locations almost always require a COI to prove that the production is liable for personal injuries or damage is done to the locale rather than the owner. General liability also covers defamation issues resulting from advertising, trademark infringement, unlicensed artworks, logo usage, or slander from competitors.

Including your place of business, with “floating” coverage, protects you and clients anywhere you are working. But state requirements regarding general liability often differ. Hence, a state-by-state package is more affordable than nationwide or international coverage, which must cover even the most stringent requirements.

A General Liability policy protects the business or the creator from third-party injuries and also any injuries that may happen to you. Still, it does not protect employees or “interns.” For that, you need Workers’ Compensation. Workers’ compensation will cover injury or illness, replace income or retraining fees lost to temporary or permanent injuries, and benefits and funereal costs in the case of death.

Excepting Texas, which opens up the business owner to litigation, workers’ compensation is a requirement in every state, but every state has its own worker compensation laws. If hired to shoot at an event or a location by a company, for commercial reasons, or any other, their general liability covers losses, in most cases.

But if a wedding couple hires you to cover their event, your general liability would have to compensate for any accidents (caused by you or your team or equipment) at the location, and workers’ compensation would be needed additionally to cover any of your employees. Workers’ Compensation covers ongoing rehabilitation medical expenses not only for accidents but also for illness and extra payouts for lost wages that may have been incurred from loss of workdays and funeral expenses if needed.

Live shows, festivals, conferences, and conventions, especially those with audience situations or liquor or food liability (think allergies), can push state requirements into the multimillions regarding extra purchase requirements for workers’ compensation and general liability.

Any horror stories of your own? Anyone with specific questions regarding video tech or production that they’d like to see addressed in a future post? Let us know!

Author: David Alexander Willis

David Alexander Willis has held editorial positions at American Cinematographer, PDN, Outdoor Photographer, PCPhoto, Digital Photo Pro, and several other magazines. David is also a writer at Lensrentals, covering the myriad needs, technologies, and techniques of cinematography and video.

-

Alex Greenfield

-

Daniel Wharton

-

Chris Padilla

-

Supreme Dalek